Time In the Market

Ask a CIO #18

Have you heard about the ‘Crystal Ball Challenge’? Quick summary if you haven’t – a couple of researchers came up with a clever way to show that it’s hard to predict how markets will react to macroeconomic data.1

The researchers ran an experiment using historical market and economic data and simulated giving players one day advance notice of important data releases. The players could then trade on that information. The result: it didn’t really matter if players knew the future (and position sizing is harder than people think).2

I’ve talked here before about my own observations on how markets can be unpredictable in terms of reacting to new data and events. It’s liberating to be reminded that we don’t need to try to predict macro outcomes, and in fact, we might be better off avoiding that distraction.

I think this experiment also speaks to the general futility of trying to time markets. We can’t predict the future, but apparently, even if we could, it’s still a crapshoot.

How worried are you about the markets leading into this year’s elections? The S&P 500 is up significantly, and it feels like the market could be headed for a correction.

You’re right that the S&P 500 has done well this year. Through September 30, the S&P 500 has returned 22.1%!3 But before we dive into your concern about a possible market correction, let’s start with your comment regarding the upcoming elections. It turns out, looking at historical market experience, major elections aren’t particularly disruptive to markets.

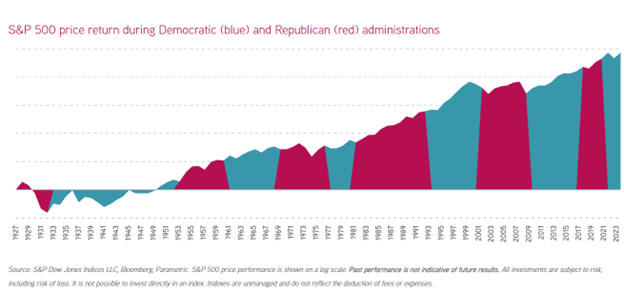

Borrowing heavily from Parametric’s research, you can see in their chart below that, since 1928, the average return and volatility of the S&P 500 Index doesn’t vary much between election years versus non-election years.

And you didn’t ask this, but I’ll share anyway, it would appear that the S&P price performance is also relatively unaffected by the political party in office.

So if the upcoming elections and the aftermath are not necessarily a reason for concern, what about your second point – the feeling that a market correction might be overdue?

While I agree that the equity market feels expensive (and any number of commonly referenced signals might suggest the same), the market doesn’t much care about our feelings.

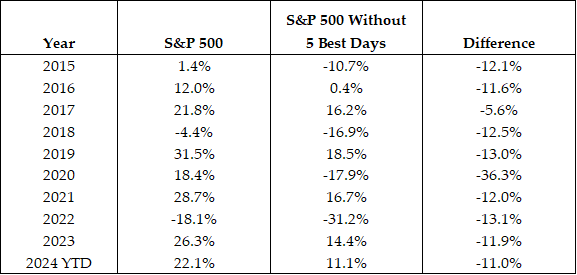

You’ve probably heard the old adage: time in the market beats timing the market. And you might also have heard that the market’s best performing days each year account for a large portion of returns. But seeing the difference can be a harsher reminder of this lesson.

There are multiple ways to parse the data, but for the table below, I chose to pull out the 5 best performing days each year.4 In other words, over the past 10 years, if you weren’t invested consistently, and you happened to miss the 5 best days each year, how much would you miss?

A lot. The answer is – a lot.

It’s hard to overstate the value of consistency when it comes to investing. Consistency in process, in strategy, in asset allocation, and in staying invested.

Having said all the above, I understand why you’re asking this question. It can be tempting to wait for a market correction or the next great buying opportunity. There are professional investors who hold cash and make that same choice. And it’s almost certain that a market correction will occur at some point in the future.

But the difficulty of timing the market well is high and so is the opportunity cost if you miss the best days in the market. Ultimately, I think an investor’s time and energy is generally better spent elsewhere.

To repeat some of our earlier newsletter advice: pick an asset allocation with diversification and stick with it, rebalancing as appropriate.

Wishing a happy new year to those who celebrate! As always, reach out anytime: askacio@ivyinvest.co.

Until next week,

Wendy

The FT summarizes the experiment here: A crystal ball wouldn’t make most of us rich (ft.com)

Source: Bloomberg

Source: Bloomberg, Buena Capital internal research